Taking Control of Healthcare Costs: Why Nevada Businesses Choose Self-Funding

If you’re a business owner or HR professional in Nevada, you probably know all too well the frustration of skyrocketing healthcare costs. Traditional health insurance plans often feel like a black hole, with premium hikes and limited control over how your money is spent. But there’s good news—self-funded insurance is offering a fresh way for businesses to regain control over their healthcare costs. Let’s dive into how it works and why it might be the right move for your company.

Take Control of Healthcare Costs: A Guide to Self-Funded Insurance

In today’s fast-paced business world, controlling healthcare costs isn’t just important—it’s essential. Traditional health plans often leave companies feeling powerless, with unpredictable premiums and a lack of transparency. But self-funded insurance offers a way to flip the script, giving businesses the power to manage their healthcare expenses more efficiently.

Many companies face growing healthcare spending that stretches their budgets and diverts resources away from critical business functions. The system can feel rigged against employers, but the good news is that an alternative exists. Self-funding provides a proactive approach, allowing companies to take back control of their health plans and costs.

Curious how this could work for your business?

Schedule a consultation with Triforta and discover how to implement a self-funded model that suits your needs.

Dispelling the Myths Surrounding Self-Funded Insurance

There’s a lot of misinformation out there about self-funded insurance, especially for mid-sized businesses. You might have heard that it’s too complicated or risky, but let’s clear up those myths and see how self-funding could be a game-changer for your business.

Myth 1: Self-Funding Is Overly Complicated

The insurance industry loves to create a sense of complexity, but the reality is that transitioning to a self-funded model can be simpler than you think. Experienced partners like Triforta make the process seamless, with minimal disruption to your existing benefits structure. Employees typically keep their current providers, making the switch almost unnoticeable from their perspective.

In practice, moving to self-funding often involves just a few meetings and some paperwork. With the right guidance, it’s a straightforward process that offers ongoing support and simplification throughout.

Ready to simplify your healthcare management?

Connect with our experts for a seamless transition to self-funding.

Myth 2: Self-Funding Is Too Risky

It’s true that the word “risk” can feel heavy in the business world, especially when it comes to healthcare. But let’s rethink that assumption. Self-funded programs often work with captives—organizations that pool resources from like-minded businesses. This approach creates a safety net that traditional insurance often can’t provide.

And that’s not all. These programs include

stop-loss coverage, which serves as a backup plan for catastrophic claims. This extra layer of protection ensures financial stability, even in unpredictable situations. So, while it may sound risky at first, self-funding can offer a more secure, cost-effective alternative when managed correctly.

Myth 3: Now Isn’t the Right Time to Switch

It’s easy to feel stuck with traditional insurance, thinking you have to wait for the “perfect” moment to make a change. But here’s the reality: there’s never a perfect time, and the longer you wait, the more you lose out on potential savings. Whether it’s a good or bad year for claims, traditional plans guarantee one thing—premium increases.

With self-funding, you gain control over your budget and can strategically plan for the future instead of reacting to external pricing decisions. It’s about stabilizing your healthcare costs, and there’s no better time than now to start investing in your company’s financial health.

Don’t wait—start saving today.

Get a customized quote from Triforta to see your potential savings with self-funding.

How Triforta Is Revolutionizing Healthcare Costs for Mid-Sized Businesses

At Triforta, we know that Nevada businesses—especially those with 50 to 750 employees—need solutions that provide real, measurable savings. That’s why we’ve developed a self-funded model that challenges the myths surrounding traditional insurance and empowers employers to take control of their healthcare expenses.

Here’s what our members enjoy:

● Significant Cost Reduction

Our self-funded model consistently saves members 10%-15% on healthcare costs. That’s real money going back into your business, allowing you to invest in other critical areas.

● Prescription Drug Savings

We don’t just stop at premiums; we also tackle prescription costs. Thanks to our exclusive partnerships, members save up to 50% on medications. This means employees get the medications they need at prices that make a real difference in their wallets.

● Enhanced Transparency and Flexibility

Employees benefited from better access to preventive and necessary medical care.

● Comprehensive Coverage

Switching to self-funding doesn’t mean compromising on quality. Our members still have access to a vast network of high-quality providers, including top hospitals and specialists, ensuring your employees receive the best care.

Looking to provide high-quality care without the high costs? Explore our healthcare solutions today.

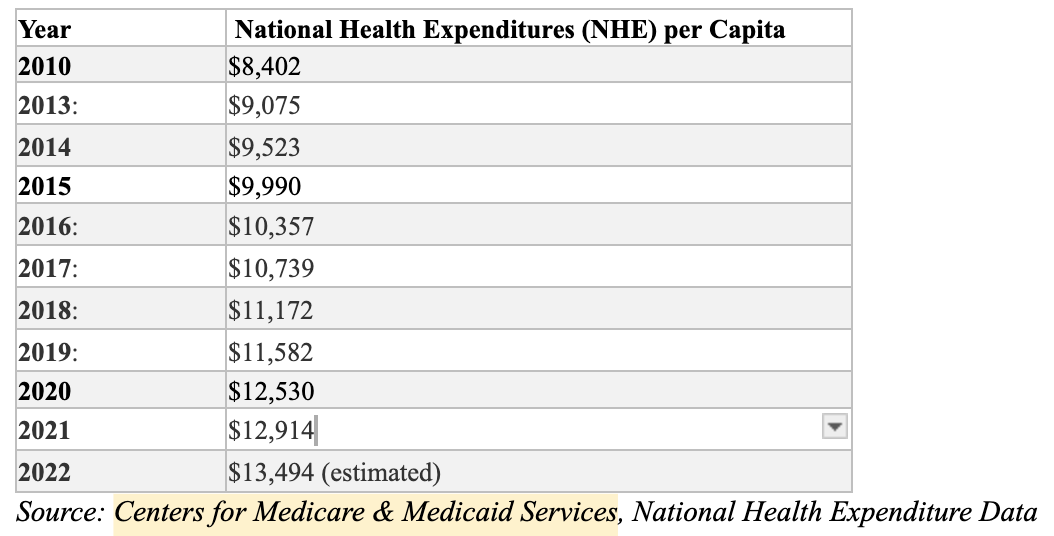

Below is a snapshot of the average national health expenditures per capita. It highlights just how much healthcare costs have climbed, emphasizing the need for cost-effective solutions like self-funding.

As you can see, the trend of rising healthcare costs isn’t slowing down. It’s more crucial than ever for businesses to explore smarter ways to manage these expenses, and self-funding offers a compelling alternative.

Conclusion

Dealing with healthcare costs can be a challenge, especially as expenses continue to rise. But switching to a self-funded model with Triforta is more than just a change in insurance; it’s an investment in your company’s future. By taking control of your healthcare expenses, you create stability, transparency, and real savings for your business.

We’re here to help you navigate these options, dispel myths, and show how self-funding can revolutionize your approach to healthcare. Whether you’re looking for reduced costs, better transparency, or a more flexible benefits plan, we’ve got you covered.

Ready to take control of your healthcare costs? Contact the Triforta team today and let’s build a plan that works for you and your employees.

Want to see how much you can save?

Get a quote now and take the first step toward financial freedom for your business.

Contact Us

Want to learn more about how we can transform your insurance strategy? Get in touch for a free consultation and see how Triforta helps Nevada businesses thrive.

CAPABILITIES

"TRIFORTA" is a registered trademark employed by the TRIFORTA Partners group of companies. All insurance offers, requests, and guidance provided through this website are delivered by licensed affiliated insurance producers of TRIFORTA, namely Elite Consulting and Insurance Services and Rodney Mattos. No offers, requests, or guidance are extended through this website in any state where one of the aforementioned TRIFORTA licensees lacks the required license. For a comprehensive list of all relevant license numbers in each state, please refer to our License Page.

New Paragraph