Understanding PBM Money Flow: A Guide for HR Professionals

As an HR professional, you're often the go-to person for employee benefits, especially health insurance. While you might be a pro at creating engaging onboarding materials or navigating the Family and Medical Leave Act (FMLA), there's one area that can feel like a financial planning maze: Pharmacy Benefit Manager (PBM Money Flow).

This complex system can leave you with more questions than answers. Understanding where the money goes—from your company's funds to the pharmacy counter—is crucial. It's not just about dollars and cents; it's about fulfilling your fiduciary responsibility and ensuring your company gets the most value out of its health plan. Ready to demystify PBM Money Flow and become a more informed advocate for your team?

Unraveling the Mysteries of PBM Money Flow

Deciphering PBM Money Flow can seem impossible, but with a little guidance, you'll become fluent in the language of pharmacy benefits and be able to explain the process to colleagues and stakeholders.

The Integration of Insurance Carriers and PBMs

In recent years, a major shift has occurred in the healthcare financing landscape, primarily driven by the strategic acquisitions of Pharmacy Benefit Managers (PBMs) by insurance carriers. This trend has significantly reshaped the dynamics between insurers and PBMs, especially after the Affordable Care Act (ACA), introduced in 2009. It's remarkable to note that a substantial part of insurance carriers' profits—nearly 50%—now originates from their integrated PBM operations.

These integrations have been bolstered by direct rebates from drug manufacturers, creating a powerful financial synergy that enhances carrier profitability. This alignment has been crucial for carriers, enabling them to streamline their operations and maximize financial outcomes effectively.

Key Developments:

- Financial Impact: The ACA has set specific medical loss ratio (MLR) requirements, mandating a minimum MLR of 80% for individual and small group plans and 85% for large group plans. However, revenues such as RX rebates, which are substantial, do not count towards this ratio, presenting a unique financial lever for insurers.

- Stock Market Influence: Since the ACA's enactment, there has been a noticeable improvement in the stock performance of major insurers, outpacing even the S&P 500. This indicates that while the ACA aimed to curb excessive profits to ensure more spending on care, it has, paradoxically, created environments where carriers can flourish financially.

- Vertical Integration: The trend towards vertical integration, where insurers not only own PBMs but also sometimes extend into direct healthcare provision and specialty pharmacies, further complicates the financial landscape. This integration often leads to higher costs and less transparency, which can adversely affect both employers and employees by pushing up premiums without a corresponding increase in value.

These integrations and the financial intricacies they introduce are reshaping not just how health plans are managed but also how benefits are perceived and utilized by employers and employees alike. As these dynamics evolve, the role of HR professionals in navigating this complex terrain will be more crucial than ever, underscoring the need for enhanced understanding and strategic management of health benefits.

Next, we will delve into the specific roles of each key player in the PBM money flow, providing clarity on how these entities interact within this integrated landscape and what it means for your company.

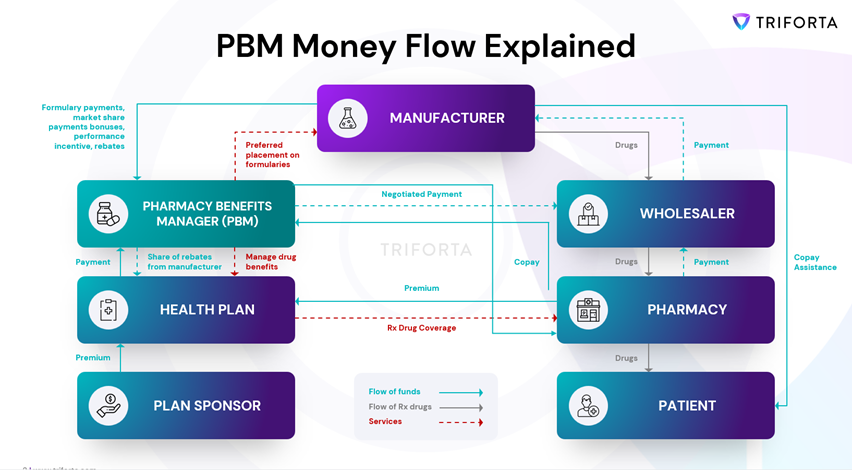

Key Players in the PBM Money Flow

Let's introduce the key players in this intricate ecosystem. Each one has a specific role, and understanding their interactions is critical to grasping the big picture.

Plan Sponsor (the Employer): Your organization, which is responsible for funding and managing the health plan.

Health Plan: The insurer that administers the health plan and negotiates with healthcare providers, including PBMs.

Pharmacy Benefit Manager (PBM): This is where things get interesting. PBMs manage the prescription drug benefits offered through your company’s plan.

Drug Manufacturer: The pharmaceutical companies that develop and produce medications.

Wholesaler: Intermediaries who purchase medications from manufacturers and distribute them to pharmacies.

Pharmacy: Your local drugstore where patients fill their prescriptions.

Patient (the Employee): The ultimate recipient of healthcare services who rely on the plan for their prescription medication coverage.

Connect with Triforta today to see how you can optimize these interactions and enhance your company's benefits strategy.

Schedule a consultation.

Following the Money: The PBM Money Flow Cycle

Now that you’ve met the players, let's trace the path of the PBM Money Flow. Understanding this cycle will help you see the bigger picture and how each component interacts within the system.

Plan Sponsor to Health Plan: The journey begins with the plan sponsor—your company—contributing funds to the health plan.

Health Plan to PBM: The health plan then allocates a significant portion of these funds to the PBM.

PBM to Pharmacy: The PBM reimburses pharmacies for dispensing medications to plan members (your employees).

Pharmacy to Wholesaler: The pharmacy then uses a portion of those funds to pay the wholesaler for the medications.

Wholesaler to Drug Manufacturer: Finally, the wholesaler pays the drug manufacturer, completing the cycle.

Hidden Currents That Impact Medication Benefits: Rebates, Fees, and Other Intricacies

The PBM money flow isn’t a straightforward one-way street. It's a dynamic and multifaceted process with several hidden currents that can significantly influence costs and outcomes. Let's explore some of these intricacies to better understand how they impact your company's healthcare spending.

Rebates: Drug manufacturers offer rebates to PBMs in exchange for placing their medications on preferred formulary tiers. PBMs then pass a portion of these rebates back to health plans, and, in turn, employers often see a reduction in premiums.

Admin Fees: Health plans charge plan sponsors administrative fees for managing the plan. These fees are generally separate from the money that flows through the PBM channel. Transparency is critical here as well; understanding what you're being charged for and ensuring these fees are reasonable can help you manage costs more effectively.

The Specialty Pharmacy Factor

Specialty medications are high-cost drugs that require special handling and patient management. These medications make up a large portion of drug spend and can significantly impact your overall pharmacy costs. Some PBMs have their own in-house specialty pharmacies, which can influence the cost and availability of these medications. Understanding the role of specialty pharmacies in your PBM's network and how they affect your costs is crucial for effective management.

Conclusion

PBM Money Flow doesn't have to be an overwhelming experience. By understanding the players involved and the intricacies of the process, you can become a more informed advocate for your company and your employees when it comes to managing prescription drug benefits. Remember, asking the right questions, demanding transparency from your PBM and health plan, and staying informed about industry trends will empower you to make sound decisions and optimize your company’s health plan.

At Triforta, we're dedicated to fixing health insurance in Nevada. Our commitment to delivering health insurance solutions is marked by unparalleled transparency, control, and substantial cost savings. Ready to transform your health insurance management approach? Join our mission today at Triforta.

CAPABILITIES

"TRIFORTA" is a registered trademark employed by the TRIFORTA Partners group of companies. All insurance offers, requests, and guidance provided through this website are delivered by licensed affiliated insurance producers of TRIFORTA, namely Elite Consulting and Insurance Services and Rodney Mattos. No offers, requests, or guidance are extended through this website in any state where one of the aforementioned TRIFORTA licensees lacks the required license. For a comprehensive list of all relevant license numbers in each state, please refer to our License Page.

New Paragraph