Self-Funded Insurance: Revolutionizing Employee Benefits

In today’s competitive business landscape, managing healthcare costs while maintaining attractive employee benefits is more challenging than ever. One solution that’s gaining traction is self-funded insurance, particularly through captive insurance arrangements. This innovative approach offers a powerful combination of control, flexibility, and potential cost savings that traditional fully-insured plans simply cannot match.

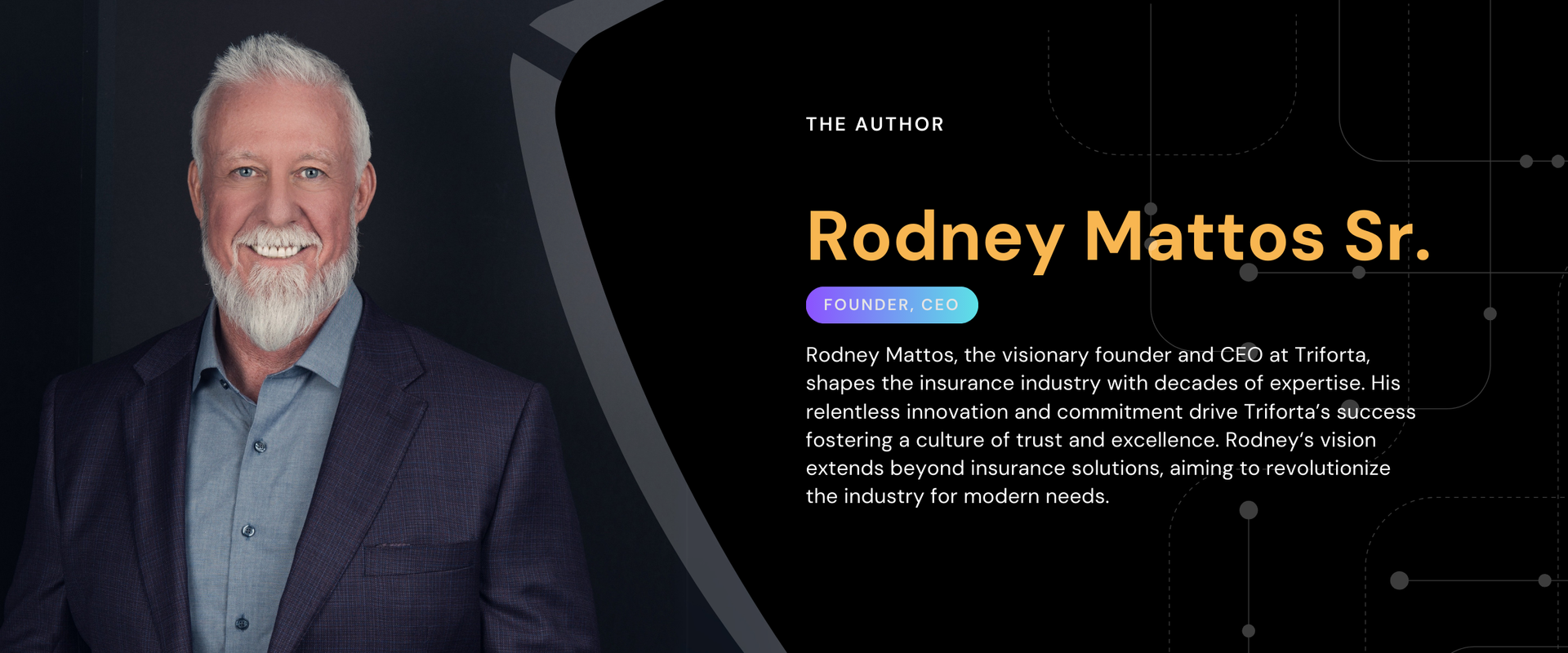

With over two decades of experience in the insurance industry, I’ve seen firsthand how self-funded insurance and captives can transform a company’s approach to employee benefits. In this blog, we’ll explore why this strategy is becoming increasingly popular, especially among mid-sized businesses, and how it could revolutionize your company’s healthcare offerings.

Understanding Self-Funded Insurance and Captives

Before diving deeper, let’s clarify what self-funded insurance and captives really are. In a self-funded health insurance plan, employers take on the financial risk of providing health benefits to their employees. Rather than paying a fixed premium to an insurance carrier, employers cover claims directly as they occur. This allows for greater flexibility and can lead to significant savings if claims are lower than anticipated.

Captive insurance goes one step further. It’s a form of self-insurance where a group of employers creates their own insurance company, sharing risk and leveraging collective buying power. This setup offers better control over healthcare spending, often resulting in lower premiums and potential savings for all involved.

Ready to explore self-funded insurance options for your business?

Contact Triforta for expert guidance on transforming your employee benefits program.

The Rise of Self-Funded Insurance in the Modern Workplace

Self-funded insurance has existed for years, but its popularity has surged recently. In fact, according to the Kaiser Family Foundation, 67% of covered workers were enrolled in a self-funded plan by 2020, compared to 61% the previous year. This rise is especially notable among mid-sized companies, who are increasingly turning to self-funded options after being priced out of fully-insured plans.

But what’s driving this shift? Companies are realizing that self-funding offers distinct advantages:

● Greater control over plan design

● Greater control over plan design

●

Access to detailed claims data

●

Potential for substantial cost savings

Additionally, self-funding allows employers to better respond to their workforce's specific healthcare needs, giving them the flexibility to offer customized benefits that align with employee expectations and the company’s budget.

Curious about how self-funding can work for your business?

Download our free guide and take the first step towards a smarter benefits strategy.

The Power of Captive Insurance Arrangements

While self-funded insurance brings clear benefits, captive insurance arrangements take these to the next level. A captive insurance model enables employers to pool resources, creating their own insurance company and sharing risks. For mid-sized companies, this collective approach allows them to enjoy the perks of self-funding while mitigating some of the inherent risks.

Strength in Numbers: How Captives Work

In a captive insurance arrangement, member companies pool their resources to form an insurance company. The collective approach provides key advantages:

1. Shared Risk

Captives spread risk across multiple companies, protecting individual members from catastrophic claims.

2. Buying power

The size of the captive allows for better negotiation on stop-loss coverage and administrative services.

3. Customization

Captives can tailor their offerings to suit the specific needs of member companies.

4. Potential returns

If claims are lower than expected, members may receive dividends or premium reductions in future years.

Captives offer the unique benefit of collaborative management, allowing member companies to leverage each other's experiences and data to make informed decisions that benefit the entire group.

The Financial Advantage of Self-Funded Insurance and Captives

One of the most compelling reasons to consider self-funded insurance and captives is the potential for

significant cost savings. Here’s how this works:

Eliminating the Middleman

In a fully-insured plan, employers pay a fixed premium to an insurance carrier. This premium includes the cost of expected claims, administrative fees, and profit for the insurer. With self-funding, employers only pay for actual claims plus administrative costs, allowing for savings during low-claims years.

Tax Benefits

Self-funded plans are typically exempt from state insurance premium taxes, which can range from 2-3% of premiums. Over time, this translates into considerable savings, especially for larger companies. These savings allow employers to reinvest in their business or further enhance the benefits package offered to employees.

Custom Plan Design

Self-funding and captives give employers the ability to design benefits packages that meet their specific needs. For example, a company may opt to enhance coverage for mental health services or include additional wellness programs to address specific workforce challenges. In many cases, the flexibility to adjust benefit offerings mid-year is also a valuable advantage, allowing businesses to respond quickly to employee needs.

Want to learn how custom plan design can benefit your business? Speak with Triforta and discover your options.

Mitigating Risk in Self-Funded Insurance

While self-funded insurance provides flexibility and savings, it also comes with inherent risks. Fortunately, there are several ways to mitigate these risks effectively:

Stop-Loss Insurance

Stop-loss insurance is a critical safety net for self-funded plans, shielding employers from catastrophic claims by setting a cap on claim payments. With stop-loss, companies can protect themselves from high-cost events while still enjoying the benefits of self-funding.

Stop-loss insurance policies can be customized to fit a company’s risk tolerance, offering protection on both individual claims and the total claims cost for the entire group.

Predictive Analytics

Employers can now leverage predictive analytics to forecast future healthcare costs and identify potential high-cost claimants. By using historical claims data, companies can make proactive decisions that improve budgeting accuracy and lower overall costs.

Predictive analytics also provide employers with actionable insights into employee health trends, enabling them to implement targeted wellness initiatives that can reduce claims costs over time.

Wellness Programs

Investing in wellness programs can also help reduce healthcare costs by promoting healthier lifestyles and lowering the incidence of chronic diseases. A healthier workforce leads to fewer claims, saving companies money in the long run. Wellness programs not only provide financial benefits, but they also improve employee morale and productivity.

Looking to implement wellness programs? Explore our comprehensive wellness solutions tailored to your business needs.

Case Study: Success with Self-Funded Insurance and Captives

To illustrate the potential benefits of self-funded insurance, consider the case of ABC Manufacturing, a mid-sized company with 500 employees. Faced with rising healthcare costs—averaging 8-10% annual increases—they decided to join a captive insurance arrangement.

In their first year, ABC Manufacturing saw a 7.5% reduction in healthcare costs, and by year three, they had saved over $1 million compared to their fully-insured premiums. In addition to cost savings, they were able to offer better coverage and enhance their wellness programs, boosting employee satisfaction.

By working within a captive, they also benefited from collaborative decision-making, shared risk, and improved access to industry expertise, helping them further optimize their employee benefits package.

Is Self-Funded Insurance Right for Your Company?

While self-funding and captives offer substantial benefits, they may not be the best fit for every company. Key factors to consider include:

● Company size: Generally, companies with at least 75 employees are good candidates for self-funding.

● Financial stability: Self-funding requires the ability to manage fluctuations in claims costs.

● Risk tolerance: Companies must be comfortable with increased risk.

● Employee demographics:

A healthier workforce can lead to lower overall claims.

Not sure if self-funding is right for you? Contact Triforta for expert advice on how to evaluate your options.

The Future of Self-Funded Insurance and Captives

As healthcare costs continue to rise, self-funded insurance and captives are poised to become even more popular. Innovations such as reference-based pricing, direct contracting with providers, and the integration of telemedicine will make these models even more effective in controlling costs and improving health outcomes.

As technology advances and new strategies emerge, businesses will find even greater opportunities to reduce costs and improve employee health through self-funded plans and captives.

Conclusion

Self-funded insurance and captives offer a unique opportunity for companies looking to take control of their healthcare costs while providing enhanced benefits to their employees. By embracing these models, businesses can enjoy flexibility, cost savings, and improved access to valuable claims data.

Interested in taking control of your healthcare costs? Get in touch with Triforta to explore how self-funded insurance can transform your employee benefits strategy.

CAPABILITIES

"TRIFORTA" is a registered trademark employed by the TRIFORTA Partners group of companies. All insurance offers, requests, and guidance provided through this website are delivered by licensed affiliated insurance producers of TRIFORTA, namely Elite Consulting and Insurance Services and Rodney Mattos. No offers, requests, or guidance are extended through this website in any state where one of the aforementioned TRIFORTA licensees lacks the required license. For a comprehensive list of all relevant license numbers in each state, please refer to our License Page.

New Paragraph